To binge or not to binge. Part 2 – barriers of SVoD adoption

Congratulations to Netflix and Amazon for winning their first Oscars! This marks a watershed in the history of subscription video on-demand (SVoD) streaming services as they increasingly gain traction in the big screens.

The earlier edition of Asia Express looked at how common SVoD services were in Asia, namely the Philippines, Singapore and India. This edition looks at potential barriers to adoption – why aren’t non-adopters jumping onboard to subscribe to SVoD services?

Pricing is important, but not everything

For subscription based services, it’s fairly common that price is a key barrier of adoption. This seems to be the case for the US, where it was the top reason for not subscribing to SVoD services (54%). The story however changes a bit when shifting focus to Asia.

Interestingly, pricing was less of an issue for the Philippines (44%) and India (30%). In India, more people stated that they didn’t subscribe since their TV wasn’t connected to the internet (42%) or that they didn’t like to be tied down to monthly subscriptions (44%). This latter reason of being tied down was the top detractor for the Philippines (65%) and Singapore (59%).

Table 1 – Q. Which of the following best describes why you currently do not subscribe to any video streaming service? (Select all that apply)

(Among non-adopters of SVoD services)

The difference with the US may in part be that the concept of monthly subscription based streaming services is still fairly new in these Asian countries – introduced only in 2015 vs 2007 in the US. Further promotion of benefits of monthly subscriptions vs one-off purchases and rentals may help increase acceptance.

Netflix competes over screen time… or in Asia, simply time in general

In the earlier edition, we saw Netflix securing a prominent position in the market for these three Asian countries. Among surveyed respondents:

- – Top in the Philippines (ahead of iflix and HOOQ)

- – Second in Singapore (behind StarHub Go and ahead of Amazon)

- – Third in India (behind hotstar and Amazon)

This time around we asked overall interest in subscribing to Netflix among those who currently don’t. We saw earlier that Singapore and the US are more sensitive to price vs the Philippines and India, and this seems to be reflected in their interest of Netflix.

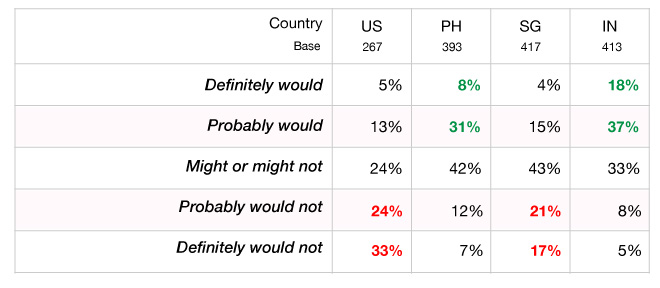

While we understand that people from different cultures answer differently to scales, it’s notable that non-Netflix users in Singapore and the US are substantially less interested in subscribing to Netflix in the coming year (57% in US, 38% in PH say definitely/probably would not subscribe in next year, vs 19% in PH and 13% in IN).

Table 2 – Q. You mentioned that you currently do not subscribe to Netflix. How likely would you be to subscribe to Netflix in the next year? (Select one)

(Among non-subscribers of Netflix)

We looked at some of the verbatim for reasons other than pricing for why people are not interested in Netflix (definitely/probably would not subscribe). Interestingly, we see much more reference in Asia to “not having time to watch shows/movies” to make up for the monthly investment. Whereas in the US, people typically already have some type of streaming service or are just not interested.

“I am satisfied with my current options and do not watch enough to justify it.” (US)

“Do not have time to watch the programs on Netflix, I am happy with whatever is available on the Free to Air channels and some free streaming from certain sites.” (Singapore)

“…I can only watch tv around 1-2 hrs daily during night time and only during weekends. Subscribing to Netflix is too much for my time and a waste of money if I cannot maximize the subscription.” (Philippines)

“I do not watch those many movies to make the money worth it.” (India)

As the old cliché goes, time is money. We’ve seen through this two-part series that subscription video on-demand (SVoD) streaming services are picking up in Asia, yet still have some hurdles to overcome. If the historical Oscars wins by Netflix and Amazon are any sign of these services gaining further share of your time, then we should brace for a life of streaming regardless of where you are. Let’s just hope it doesn’t turn out to be an envelope flop.

■Survey Details

Markets: Philippines, Singapore, India, US

Sample Size: Philippines – 501, Singapore – 500, India – 503, US – 411

Methodology: Online Survey using Rakuten AIP proprietary panels

Timing: February 14-17 2017