Snapshot: Retail Insights

In normal times, understanding the retail landscape across different markets is challenging enough, let alone during a pandemic. COVID-19 has impacted consumers as well as researchers, trying to monitor behaviour across the globe, from their homes. It is now more tempting than ever to make sense of data through one’s own lens.

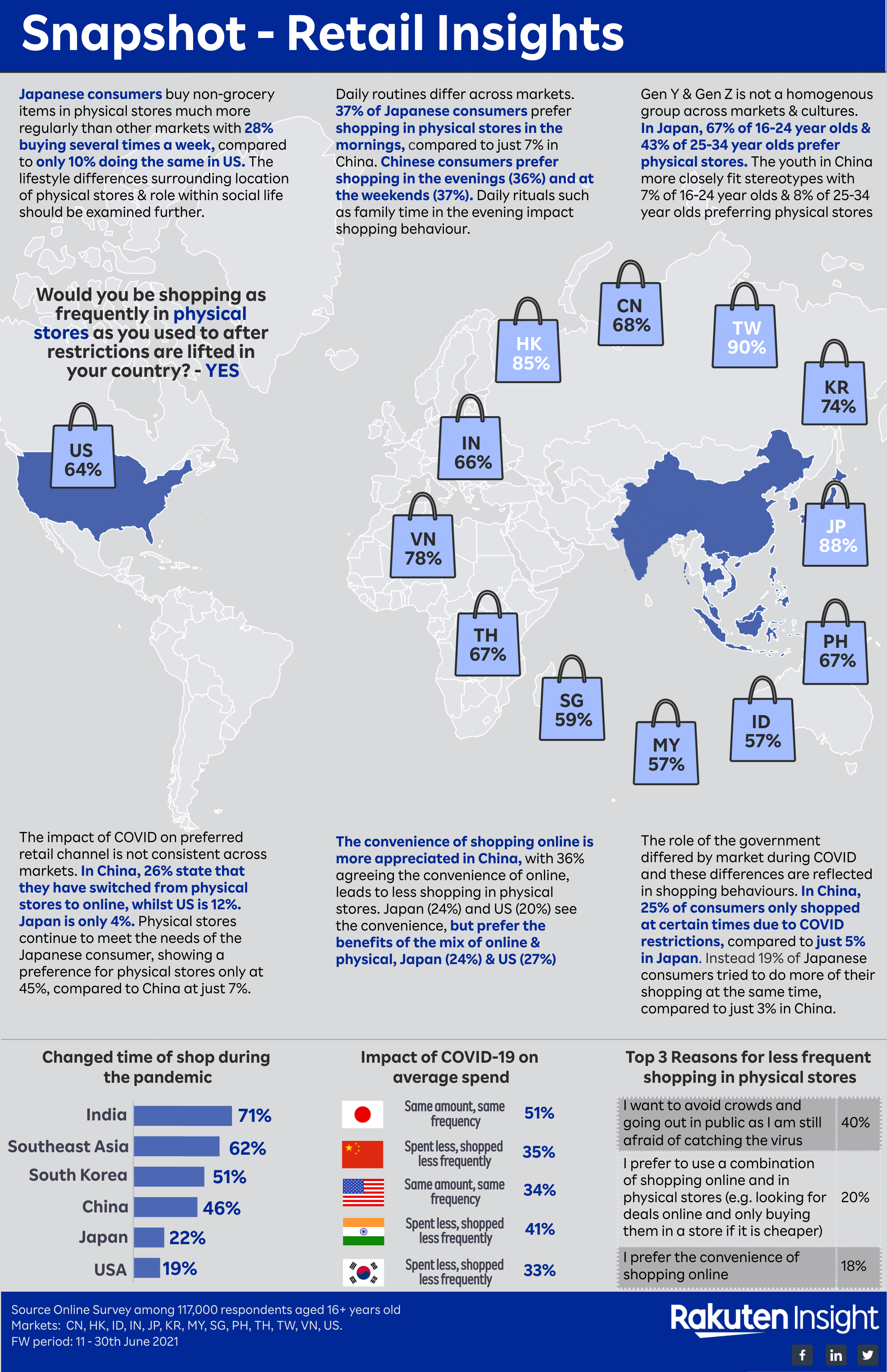

However a recent survey by Rakuten Insight Global, conducted using our own proprietary panels, has shown the importance of researchers analysing the data through a local lens. In June 2021, over 117,000 people across 12 Asian markets & US were surveyed on their shopping behaviour and the impact of COVID. The survey identified 5 key factors in understanding retail behaviour at a hyper-local level:

1. Role of local Government:

In Japan, COVID had less impact on consumer behaviour than other markets. Japanese consumers were still able to travel locally and continue visiting their local physical stores, without a major disruption to existing habits. The role of the government differed by market during COVID and these differences are reflected in shopping behaviours. In China, 25% of consumers only shopped at certain times due to COVID restrictions, compared to just 5% in Japan.2. Gen Z & Gen Y:

The traps of the generational labels Gen Z & Gen Y are well documented. The survey showed that lifestyle factors may unify Japan Gen Z & Gen Y more with their local older counterparts than Gen Z & Gen Y in other markets. In Japan, 67% of 16-24 year olds & 43% of 25-34 year olds prefer physical stores. The youth in China more closely fit stereotypes with 7% of 16-24 year olds & 8% of 25-34 year olds preferring physical stores. An explanation may be that the ageing population has led to society catering for the needs of the elderly whilst overlooking the younger age groups. Through a local lens it is less surprising that Gen Z share more with Baby Boomers in their 70s than Gen Z in other markets. Exploring the needs of Japanese Gen Z is rich territory.3. Physical Stores:

From one lens, we could expect to see a greater shift to online during the pandemic. However, the impact of COVID on preferred retail channel is not consistent across markets. In China, 26% state that they have switched from physical stores to online, whilst US is 12%. Japan is only 4%. Japan continues to see a high preference for physical stores only at 45% compared to China at just 7%. Physical stores continue to meet the needs of the Japanese consumer. The needs met by physical stores may include: ability to see & touch product for themselves, social environment with friends and family, habit (automatic) & low risk (I know what I’m buying).4. Daily routines:

Daily routines differ across markets. 37% of Japanese consumers prefer shopping in physical stores in the mornings compared to just 7% in China. Chinese consumers prefer shopping in the evenings (36%) and at the weekends (37%). Through the local lens in Japan, daily rituals impact shopping behaviour. These rituals may include family time in the evening, over food, bathing & simply winding down together.5. Physical placement of shops:

Throughout the pandemic, Japanese consumers have been able to shop in physical outlets and travel on public transport. The survey found Japanese consumers buy non-grocery items in physical stores much more regularly than other markets, with 28% buying several times a week, compared to only 10% doing the same in US. In Japan, retail is often made easy for locals. Many shops surround the populous public transport stations, meaning a quick visit to the store on the way home is very convenient. This can be different in US, where shopping may be a separate trip by car require an extra effort, that can lead to a preference to shop online.

Click here to download the infographic

Don’t make the mistake of reading the data through the wrong lens. Please consult with local experts to view the data though a hyper local lens to uncover the true insight!

Related Articles: Inside China: Super Apps & Role of Brand, Environmental responsibility during and post pandemic