Report: Online shopping – what’s changed?

Over the past 2 years, the global pandemic has fundamentally changed the world–the way we live, work, travel and consume. Facing lockdowns and subsequent restrictions to retail and leisure activities, consumers around the world were forced to adopt new digital behaviours.

E-commerce helped many navigate the pandemic, from online shopping to food delivery services. But as restrictions ease, the question is: how permanent will the shift to online shopping be?

In June 2022, Rakuten Insight Global interviewed over 134,000 adults 16+ years old across our 13 proprietary panels (China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Thailand, Taiwan, United States, Vietnam) to find out how their online shopping and digital spending behaviours have changed compared to the same period last year.

Online shopping post-pandemic still needs to address some consumer concerns

Online shopping grew during the COVID pandemic. In those we surveyed, the key benefits of online shopping are seen to be convenience (52%), the smooth, positive consumer experience (46%) and the great deals (34%).

In addition to those benefits, during lockdown consumer choice and freedoms were naturally restricted. Consumers could only shop from the safety of their homes. However, post-pandemic two factors have led to less online shopping. This reduction may highlight consumer concerns over the online experience.

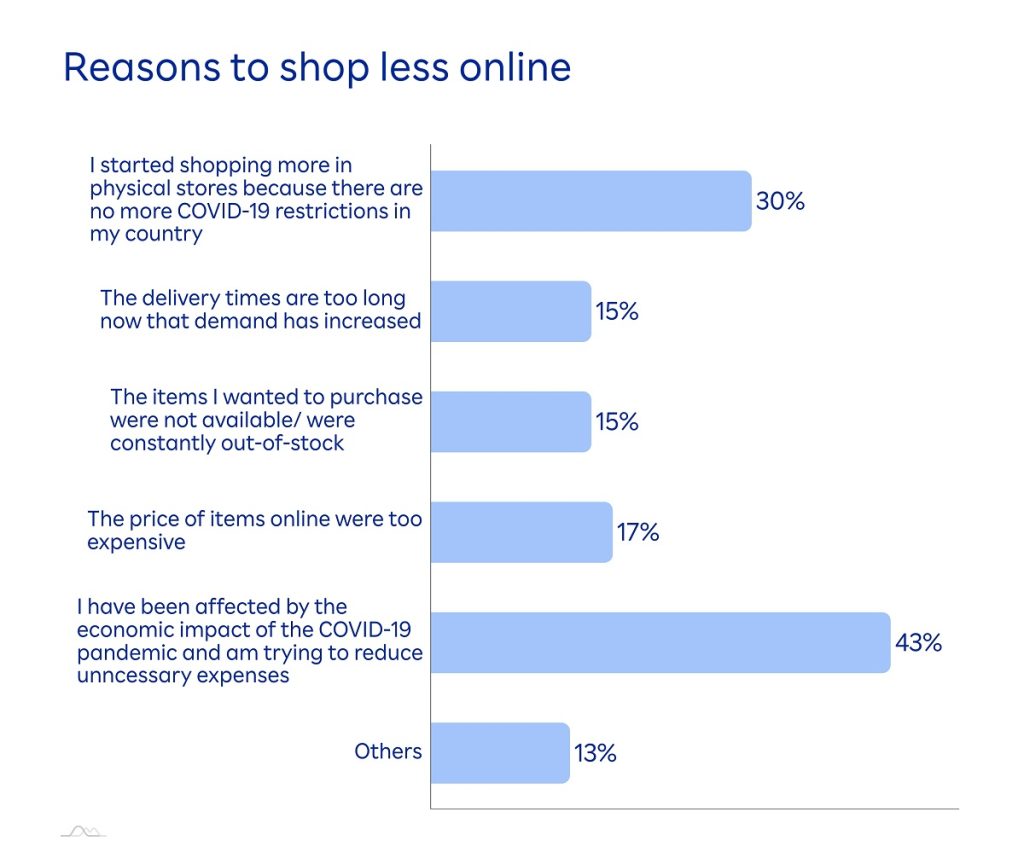

Firstly, 43% stated they bought less due to being affected by the economic impact of COVID-19 and trying to reduce unnecessary expenses. The underlying concern being here that it is all too easy to click on deals and make spontaneous purchases which are not necessary and that one may regret later.

Secondly, 30% of consumers started to shop more in physical stores due to no more COVID restrictions. This shows that almost 1 in 3 see the advantage of the physical experience over the virtual one.

Online shopping provides the convenience for all. However, the most convenient device reflects your generation

Online shopping provides convenience to all generations. However, the preferred device changes depending on one’s generation. This could be an opportunity for smartphone brands to address concerns amongst the older generation. Potential concerns could include perceived usability and security barriers.

Gen Z & Millennials have a strong preference for the smartphone with 87% and 91% respectively. This preference for the convenience of the smartphone contrasts with the older age groups, especially the Baby Boomers (61%).

There is also a large generation gap in Desktop purchases. Only 14% of Gen Z chose desktop, whilst 33% of Baby Boomers prefer the Desktop.

Mobile Wallets

The rise in mobile wallets such as Google Pay, Apple Pay, and Samsung Pay appears to mean it will inevitably become the dominant form of online payment. An ever-increasing number of people are confident of leaving their physical wallets at home and relying on their phones.

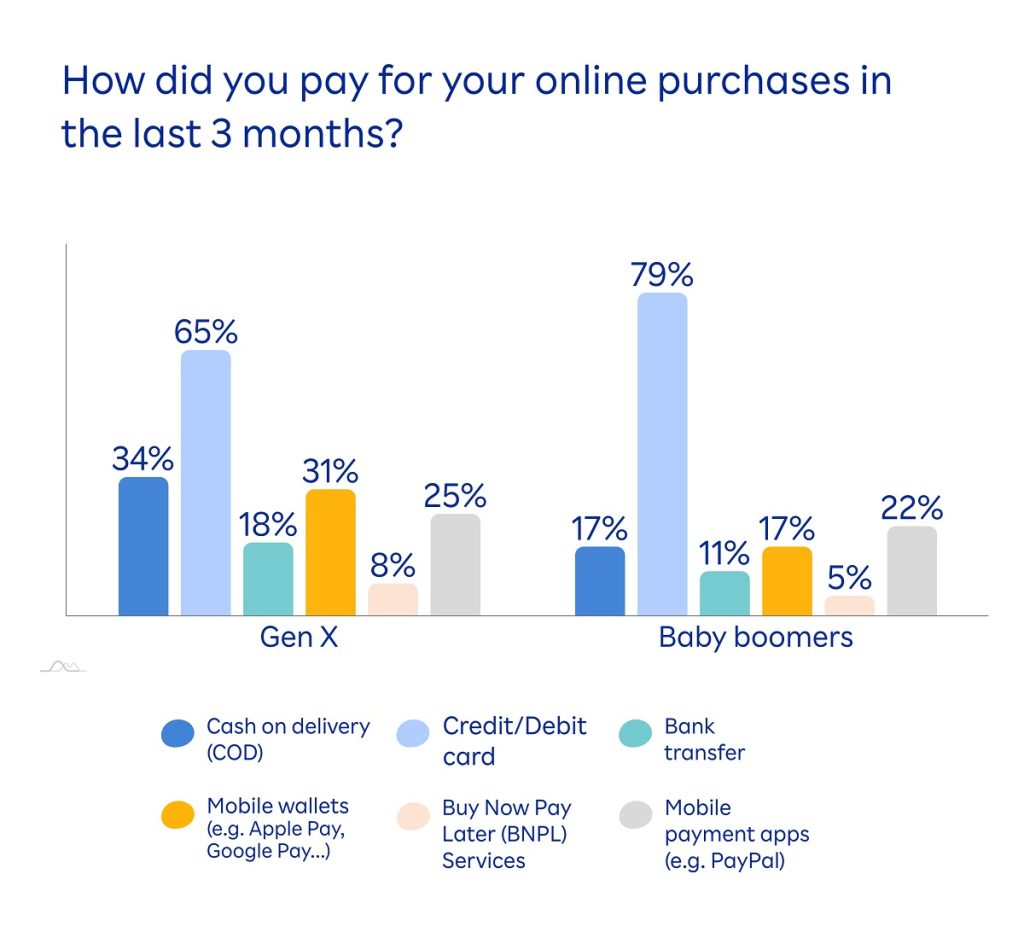

However, there is still a generation gap in the reliance on digital wallets. Whilst almost 1 in 2 Gen Z (46%) & Millennials (45%) use digital wallet, this reduces to 31% amongst Gen X and only 17% for Baby Boomers.

The physical Debit/Credit Card is the preference for the Millennials (65%) & Baby Boomers (79%). Possible barriers and concerns for digital wallets to overcome include emotional reassurance of the physical card, usability issues, and perceived security concerns.

Cash on Delivery (COD)

The main forms of payments online are Debit/Credit Card (52%) Cash on Delivery (47%) & Mobile Wallets (42%).

The 2022 FIS Global Payments Report (GPR) found COD remains an important part of Southeast Asian e-com markets including Indonesia, Thailand, and Vietnam. This holds true in our report, with Cash on Delivery appearing as a preference in South-East Asia, particularly the Philippines (85%), Vietnam (69%), and Thailand (61%). Cash on delivery was the dominant form of payment prior to the pandemic and preference for real cash transactions whilst no longer unchallenged is still preferred by many.

Whilst common in SEA, Cash on Delivery is less frequent in markets such as Japan (5%), China (11%), and US (12%). It will be interesting to see how this form of payment fares as mobile wallet usage continues to grow.

Related articles: 2022 Impact of COVID-19 on consumer behaviour, Snaposhot: Retail Insights

For more infographics, updates and our original survey reports, follow us on LinkedIn or subscribe to our newsletter at the bottom of the page.