Rakuten.Today: Global shoppers are embracing a circular economy

Originally published on Rakuten.Today, 21st July 2021.

The concept of a “circular economy” — one which designs out waste and pollution, keeps products and materials in use, and regenerates natural systems* — isn’t only winning over environment groups, it’s inspiring businesses as well. With many global companies now embracing the concepts of a circular economy, the idea seems poised for the mainstream.

But what do everyday shoppers think? A recent Rakuten Insight survey reveals that a majority of global respondents would likely be in favor of such a change.

Demand for circular and sustainable products is rising across the board

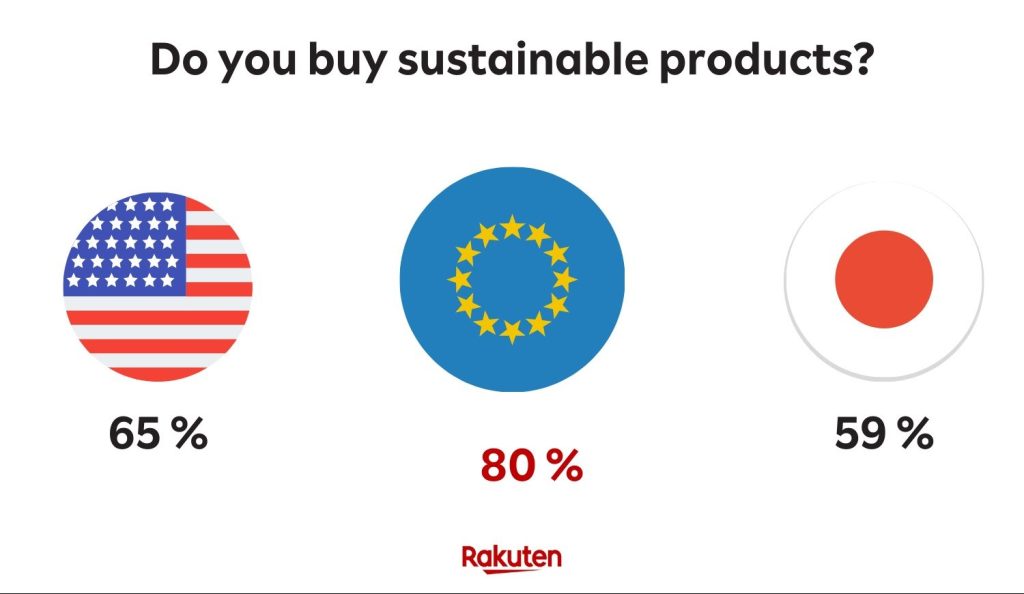

The Rakuten Insight survey — conducted among 1,800 consumers across six markets: Japan, France, Germany, Spain, the U.K. and the U.S. — indicates that the motivation to consume more consciously is already strong, while interest in sustainable brands and circular businesses is increasing.

Demand for sustainable products was highest in Spain (85%) and France (81%). On the end of the spectrum, respondents from Japan reported the lowest interest (59%). However, even in Japan, 42% of respondents stated that they were planning to increase their spend on sustainable products in the next five years.

Notably, Gen Z and Millennials showed the most interest in purchasing more sustainable products in the next five years across all markets. This trend stands out particularly in Germany (81% for Gen Z and 76% for Millennials) and Spain (80% for Gen Z and 79% for Millennials).

While in most countries Gen Z seems to be the driving force behind sustainable change, it is Millennials in Japan and France who show a higher interest in sustainable products.

In all surveyed markets there was a silent understanding about the motivation for choosing sustainable products: Because it’s better for the planet (Spain: 83%, Germany: 79%, France: 77%, UK: 76%), and better for people (UK: 54%, Spain: 53%, Germany: 48%, France: 43%).

The desire for improved product quality and affordability — especially for circular products — also played a role. On the other hand, the barriers for buying sustainable products appears to be trust-related issues, and hygiene concerns for circular items in particular.

Circular business models

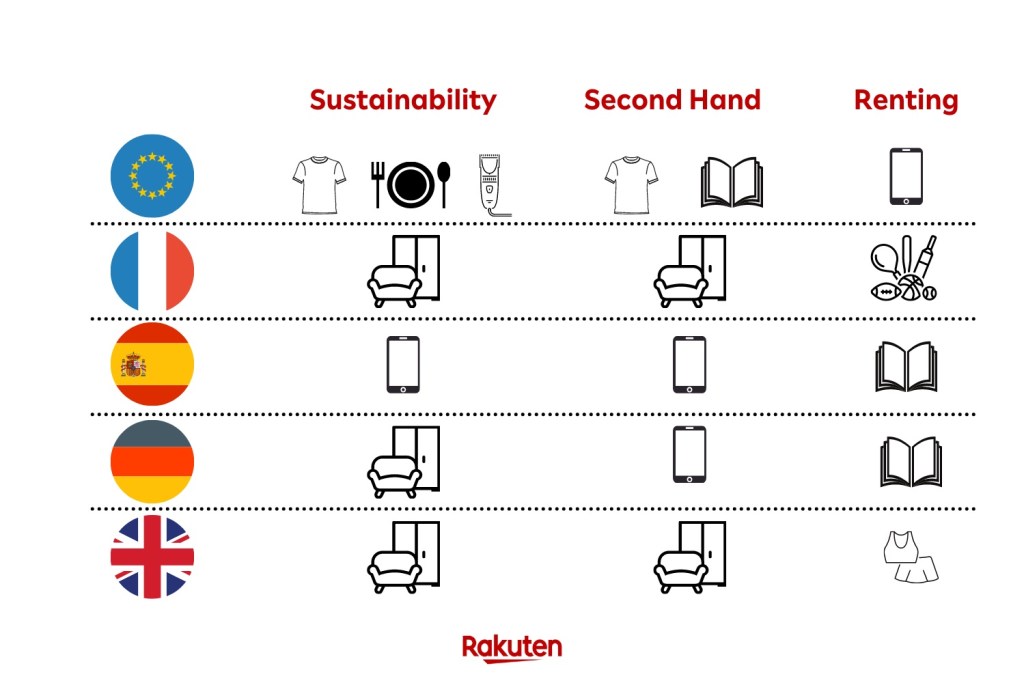

The study focused on two key areas of a circular economy: second-hand products and rental models.

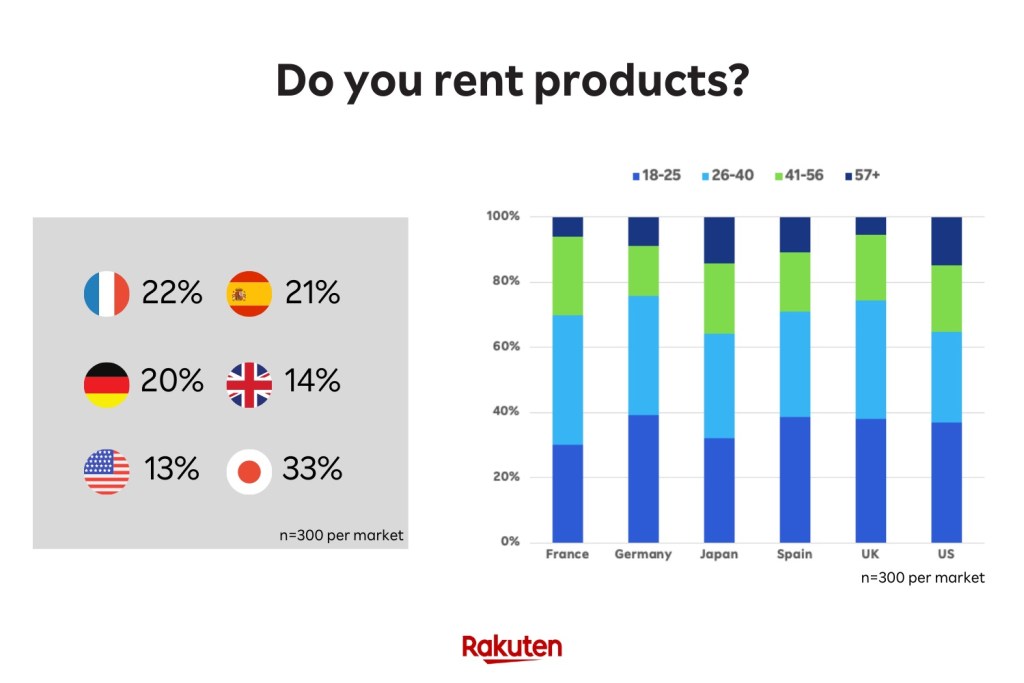

Consumers in Japan seem to be the most willing to rent compared to other markets (Japan: 33%, Spain: 21%, France: 21%, Germany: 20%, UK: 14%, US: 13%), and across all markets the main reason to rent is the assumed affordability. Preferred products were books and electronics across all markets.

Second-hand products were less popular in Japan (56%), but comparatively more popular in European markets, especially France (69%) and the U.K. (68%). In all countries, the demand for second-hand products was higher among Gen Z and Millennials.

The most popular categories for second-hand shopping were apparel, books and furniture, and the main reasons for purchasing were affordability and that these products are better for the planet.

Read the full article here.

Related articles: Report: Next Normal to Future Normal for Consumers in Asia and US, Impact of COVID-19 on Consumers’ Behaviour