ParcelMonitor.com: The E-Commerce Logistics Race South East Asia

Originally published on Parcelmonitor.com, 29th July 2021.

Southeast Asia has a booming e-commerce market. In 2020, the region’s e-commerce sector e-commerce grew by 35.2%, adding 40 million new Internet users in 2020 resulting in over 70% of the region’s population browsing the Internet. The region’s e-commerce growth also shows no signs of slowing with a forecasted growth of 14.3% this year.

With such a vibrant e-commerce landscape, how have Southeast Asian countries matched up to each other when it comes to e-commerce logistics? Which country had faster delivery times? Which country’s shoppers made use of collection points the most?

Here are some of the key findings:

Top platform to shop from

-

-

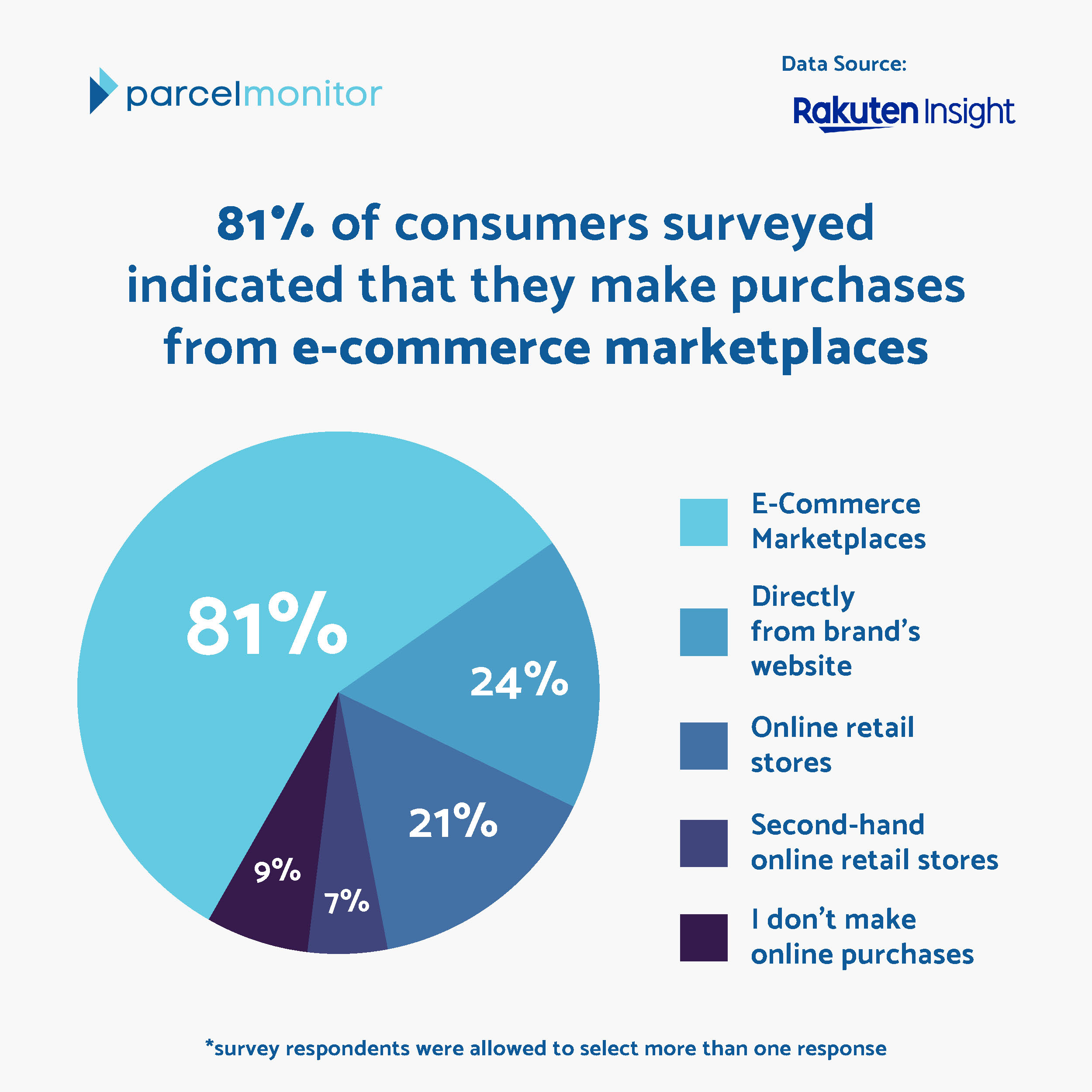

- 81% of consumers surveyed indicated that they make purchases from e-commerce marketplaces. Only 9% of respondents indicated that they do not make online purchases at all.

- 35% of Singapore customers chose to purchase directly from the brand’s website, the highest compared to its SEA counterparts.

- 16% of Vietnam customers chose to purchase from second-hand online retail store. This is the highest percentage out of all countries surveyed.

- 12% of Philippines customers indicated that they don’t make online purchases, the highest compared to its SEA counterparts.

-

Alternative delivery methods

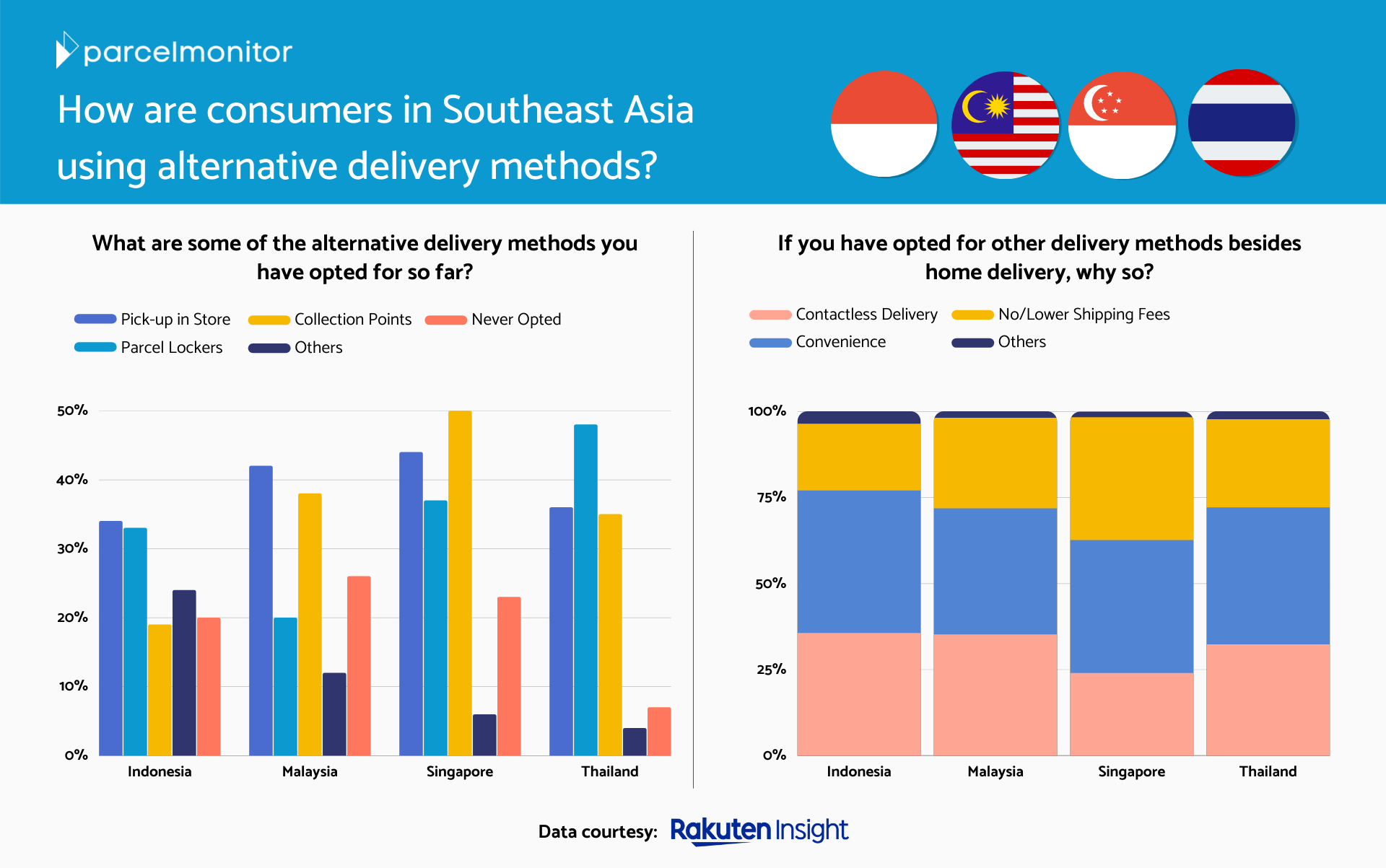

According to our survey data on Southeast Asian consumers collected over June-July 2021, collection points are the second most popular alternative delivery method. The same survey also shows that over 80% of Southeast Asian consumers surveyed have opted for alternative delivery methods, such as in-store pick-ups, parcel lockers, collection points and other forms of alternative deliveries.

The most common reasons for Southeast Asian consumers opting for alternative delivery methods are:

-

- Convenience (63%)

- The contactless and safe nature of this option (54%)

- Reduced or completely removed shipping fees (39%)

Most strikingly, in Singapore, half of the consumers surveyed have used collection points in place of home delivery, in contrast to the 38% and 19% of Malaysian shoppers and Indonesian shoppers respectively. It is no surprise that Singapore boasts the highest rates of collection points usage in the region given the government’s efforts in launching a nationwide parcel delivery locker network that is accessible to all delivery providers.

Related articles: What do consumers really think about collection points?