Japan: Feeling the squeeze!

Japan, along with other global markets, is feeling the effects of post-pandemic inflation this summer. So Rakuten Insight Japan collected data from 1,000 adults between the ages of 20 and 69 to gauge the impact of price increases on their lifestyles. And the impact is clear. About 80% of respondents revealed that they have recently observed price increases for food, with an average 14,673 yen spike in monthly household expenditure.

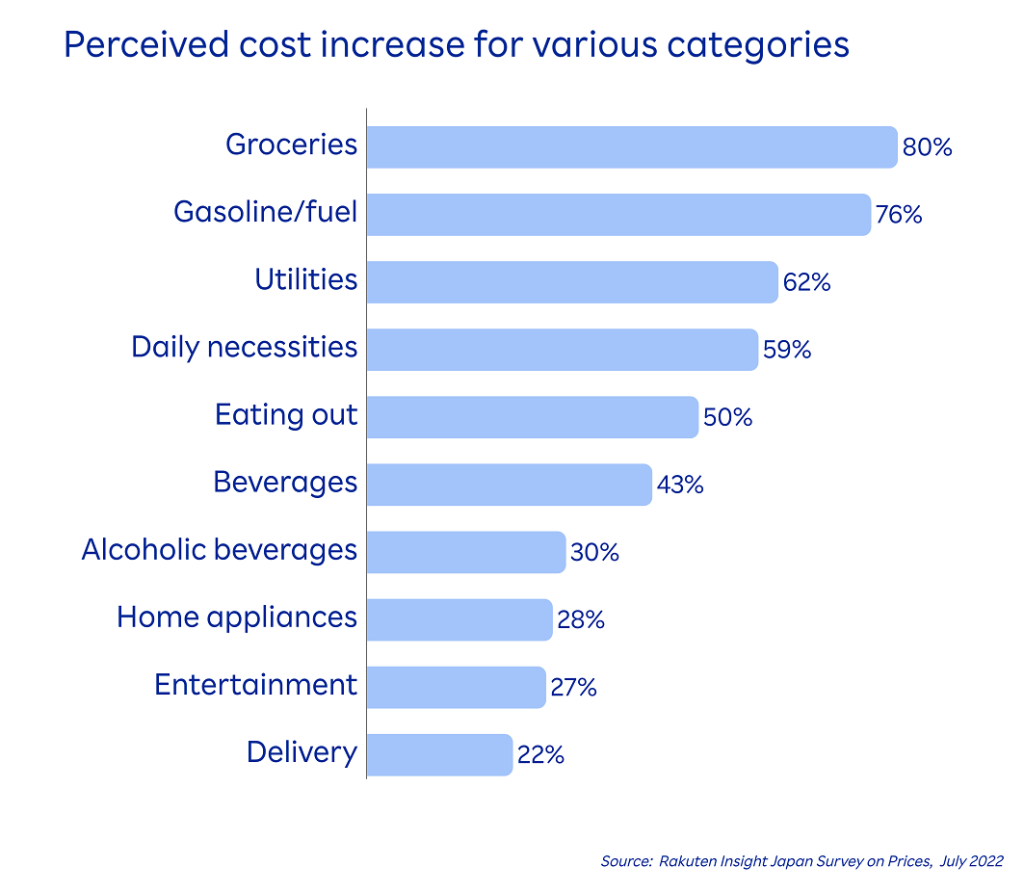

Perceived cost increase for various categories

The survey asked respondents to assess the effects of price increases on various goods and services. Overall, 80% of respondents named food as the item whose prices have risen most noticeably. This was followed closely by gasoline/fuel (76%), utilities (62%), daily necessities (59%), dining out (50%), and beverages – excluding alcoholic beverages (43%).

The majority of those polled are concerned over the food price increase. Over 40% say it will significantly impact their household budget. The result is more than 20 points higher than the next category, utilities.

Among food & drink items bought daily, fresh food (vegetables/fruits, fresh fish, meat) topped the list at 45%, followed by seasonings/oils (41%), bread (39%), and wheat flour/mixed flours/confectionery ingredients (37%).

Impact on household finances

According to the results, the average monthly increase in household expenditure due to surges in the price of goods and services is ¥14,673. By family composition, the top average is 20,563 yen for households with three or more generations of parents, children, and grandchildren, which is about ¥6-7000 higher than other family compositions.

| Average monthly increase in household expenditure due to price hikes | |

|---|---|

| Single (single person) household | ¥13,562 |

| Household with only couple/partner | ¥14,618 |

| Two-generation households such as parents and children, couples/partners and parents | ¥14,582 |

| Households with three or more generations of children and grandchildren | ¥20,563 |

| Others | ¥12,000 |

| Overall | ¥14,673 |

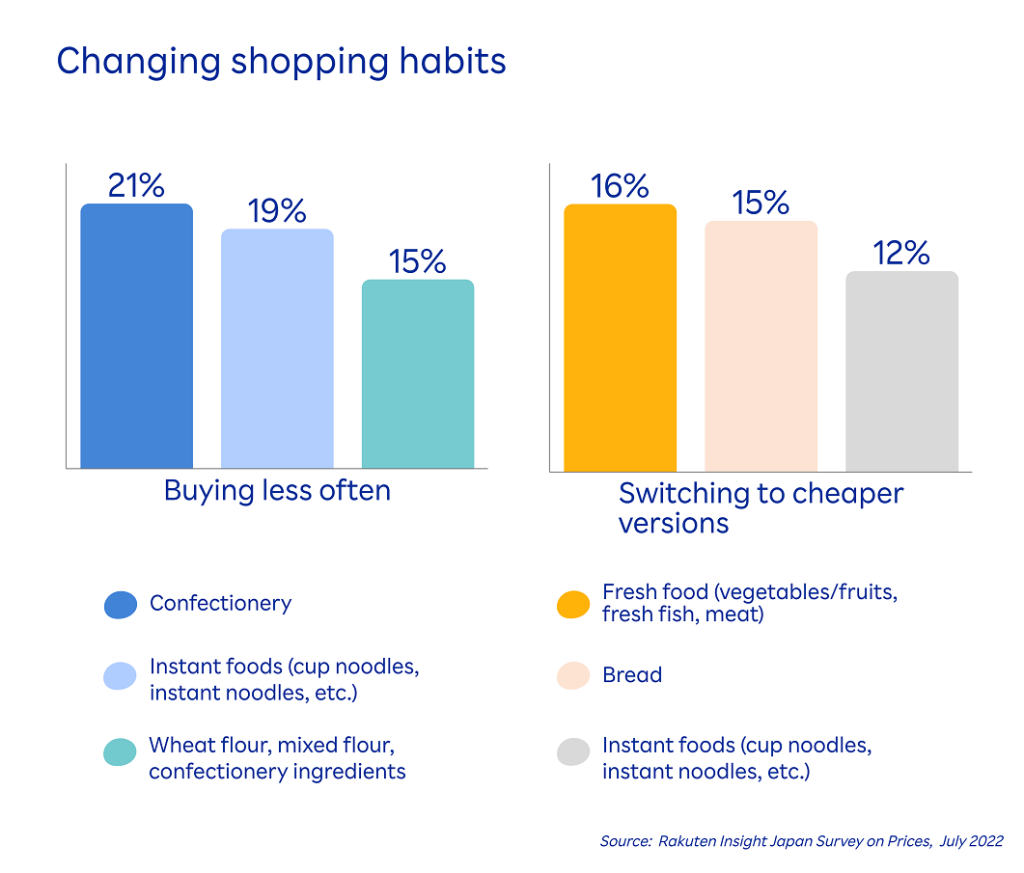

Changing shopping habits

Consumers are reacting to the price hike by cutting back on discretionary categories or switching to less expensive versions. In particular, foods that can be dispensed with, such as confectionery and instant foods or wheat flour/confectionery ingredients, are less likely to end up in the shopping basket. In the case of foods that many people can less easily do without – such as fresh food, eggs, and rice – shoppers are increasingly turning to cheaper versions and special offers to save money.

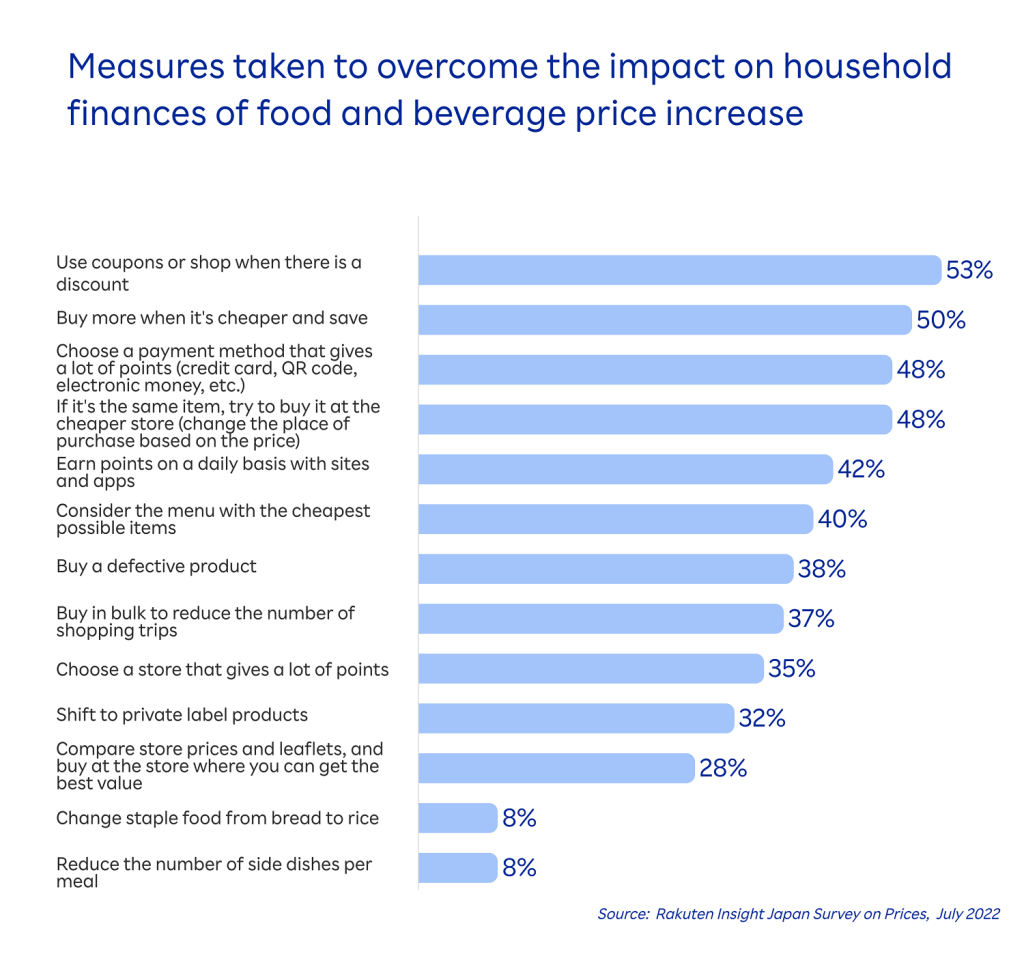

Ways to save money

The most popular answer for how consumers could cope with increasing prices was using coupons to reduce costs on groceries and other goods (53%). In addition, 50% answered ‘buy more and save when the price is low’, followed by 36% who said they had reduced consumption of food items such as meat, vegetables, and fruits.

Overall, as with the pandemic, inflation is being felt by consumers across the world and Japan is no exception. A difference in Japan is that it has been a while since inflation has been so keenly felt, so brand and marketing teams need to consider how consumers will be emotionally reacting to these turbulent times and how this may impact their purchase decisions.

Looking for a Japanese online market research panel? We’d love to hear from you!

For 25 years, Rakuten Insight Global has been at the forefront of consumer market research data collection. By combining our 1st party data with the highest levels of quality assurance processes, Rakuten Insight Global has remained our clients’ trusted research partner for Asia, US & Beyond.

Our proprietary, double opt-in online panels have been developed throughout 12 major Asian markets & the US. All of the panels are managed by dedicated local support teams and meet the highest industry standards. The Rakuten Insight Global team offers 24-hour coverage from 11 worldwide locations, providing exceptional service for 500+ clients across the globe.

Rakuten Insight Global is tasked with leveraging the 1st party membership assets of the Rakuten Group for market research purposes. Having access to such a diverse and unique group of research participants allows Rakuten Insight to remain at the forefront of online research.

Related articles: The land of the rising contradictions, A cultural analysis of trust in data collection in Japan and South Korea

For more infographics, updates and our original survey reports, follow us on LinkedIn or subscribe to our newsletter at the bottom of the page.