To binge or not to binge. Part 1 – binging in Asia

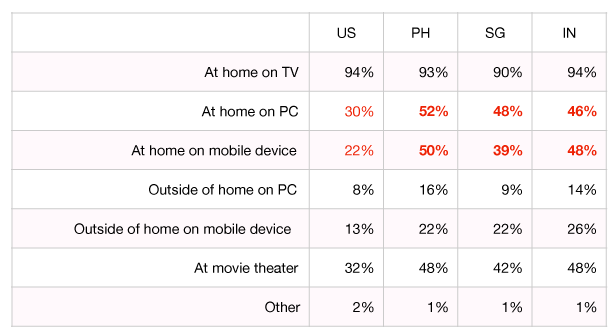

Table 1 – Q. Thinking about the past 3 months, how do you usually watch TV shows and/or movies? (Select all that apply)

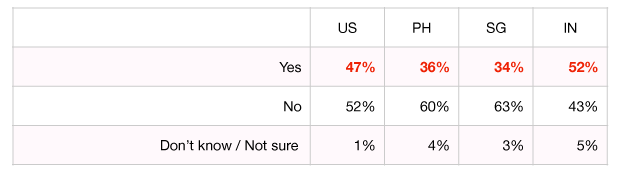

SVOD more prevalent in US and India, while less so in the Philippines and SIngapore While video streaming services have been around in the US a lot longer (Netflix 2007, Amazon 2006) than its Asian counterparts (iflix in Philippines 2015, StarHub Go in Singapore 2015, hotstar in India 2015), usage in Asia is picking up quickly. India boasts over half, while in the Philippines and Singapore roughly a third of surveyed respondents are subscribed to video streaming services.

Table 2 – Q. Are you currently subscribed to any video streaming service? (Select one)

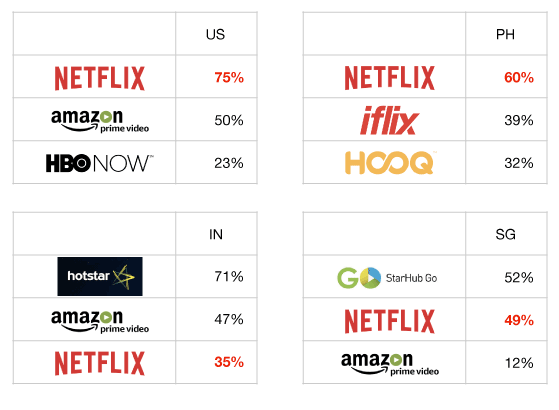

Netflix gains prominent space in SVoD, especially in southeast Asia (Philippines and Singapore) With the global expansion of Netflix in 2016 (130 new countries), Netflix has gone head-on with local competition in Asia. Among surveyed respondents, Netflix has overtaken iflix (39%) and HOOQ (32%) in the Philippines as the leading SVoD service (60%), and is in a tight race in Singapore with StarHub Go (52% vs Netflix 49%), while Amazon Prime Video there is in a distant third (12%).

Interestingly in India, hotstar is a local favorite (fueled by cricket matches and Bollywood, now with other entertainment) with a dominant 71%, with Amazon taking the second place at 47% and Netflix trailing in third (35%).Table 3 – Q. Which of the following video streaming services are you subscribed to? (Select all that apply)

Netflix chosen for original content and ease of use When asked about the reason for choosing Netflix, respondents in all four countries point to its original content and ease of use, including the ability to download for offline viewing. We picked up a few verbatim from each country:

“Easy to use. Has great original programming. Easy to binge watch.” (US)

“Netflix has good original series shows. Connecting to netflix is easy and the streaming does not take too much time. Quality of the video adjusts according to internet speed.” (Philippines)

“Can stream all the shows or download it for offline use. Has their own original series, and other popular series.” (Singapore)

“It contains a wide variety of shows and movies I am interested in watching. Also there is a download option to watch later.” (India)Even though Asia is a much younger market for subscription video on-demand services, we’ve seen that it’s picked up very quickly, especially in a market where PCs and mobile devices are heavily used to consume entertainment media. The growth and expansion of Netflix has had a significant impact on local competition. In the second part of this series, we’ll look at some potential barriers to adoption – what’s keeping those non-adopters from subscribing? Until then, binge watch your favorite shows, or if you want to take a break from your mobile devices, why not head out to the big screens and enjoy two hours of uninterrupted entertainment delight.

■Survey Details Markets: Philippines, Singapore, India, US Sample Size: Philippines – 501, Singapore – 500, India – 503, US – 411 Methodology: Online Survey using Rakuten AIP proprietary panels Timing: February 14-17 2017